A few months ago, the Autologica team joined a workshop with dealership owners and managers. At one point, the head of a large dealer group said something that stuck with us:

“When my sales team says we’ve reached our sales target, I worry—because I don’t know if we actually made or lost money.”

She wasn’t alone. You could feel it in the room. Selling brings relief, but for those of us who look at the numbers, this often happens: beneath that “goal achieved” feeling, there may be deals whose actual profit was far below target.

After the session, we spoke with her again; her team was pushing hard to meet sales targets and, in the rush, went too far with promotions or discounts. There was no clear margin threshold per transaction, nor a consistent habit of recording all costs associated with each sale. The result: their dashboard showed “target reached,” but the profitability engine was stalling.

Real Profit

The question that organizes everything is simple: what is the real profit per sales transaction?

To calculate it honestly, you need to add not just the vehicle’s price and cost, but also everything that often gets left out:

- Discounts and incentives.

- Sales commissions and bonuses.

- Documentation, registration, titling.

- Financial costs (subsidized rates, absorbed interest, time-bound bonuses).

- Sales process expenses (logistics, delivery, reconditioning).

- True valuation of trade-ins.

- And, of course, importation costs and currency fluctuations, when applicable.

When you look at this data sale by sale, patterns emerge: models that perform better, healthier stores, salespeople who build value instead of giving away margin, channels worth prioritizing.

How Did We Get Here?

There are common causes we see repeated in many dealerships:

- Unrecorded costs per transaction. Sometimes it’s process (no one enters them), sometimes it’s system (no place to enter them).

- Discounts without clear policies. The urgency to close today “borrows” from tomorrow’s margin.

- Overvalued trade-ins. An optimistic appraisal will cost us later.

- Low-margin model mix. The best-seller isn’t always the most profitable.

- Invisible financial costs. Deferred bonuses or misallocated subsidized rates distort profitability.

How Can We Address This?

There’s no magic—just discipline and measurement. To improve, we could start with three quick moves:

- Define a minimum margin per sale. Don’t close below an agreed (and documented) threshold. If concessions are needed, compensate with profitable upsells.

- Mandatory cost checklist. Before closing, all relevant cost items must be entered.

- Daily profitability dashboard per transaction. A view by salesperson, branch, source, and model. The team checks the number every day, not just at month-end.

Within weeks, the internal conversation shifted—from “Did we reach volume?” to “Did we reach margin?” And that alone straightens the course.

How to Measure With or Without Autologica

- If you use another system or spreadsheets: define the per-transaction cost model, make recording it mandatory, and build a dashboard that includes profit per transaction, segmented by salesperson, branch, source, and model.

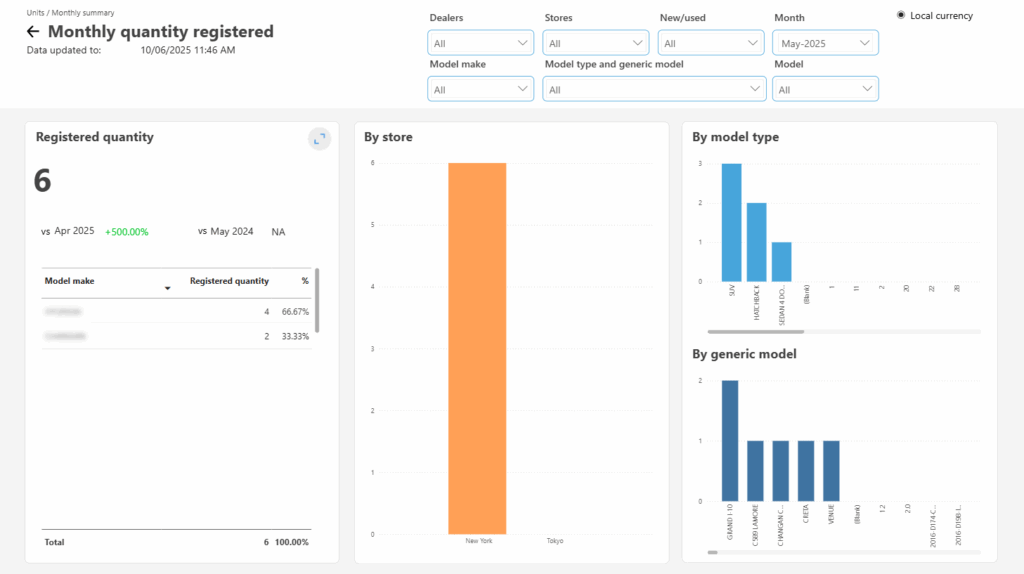

- If you work with Autologica: with Autologica Analytics you can visualize profit per transaction and drill down by branch, salesperson, model/generic model, and channel. This makes it easier to detect deviations quickly and prioritize actions without wasting time on manual consolidations.

Key point: whichever tool you use, data entry must be part of the process, not an “afterthought.”

Seven Actions That Improve Profitability (Without Self-Deception)

- Define and enforce a minimum margin per transaction. If the client asks for a discount, compensate with complementary products (accessories, insurance, warranties, maintenance packs).

- Prioritize profitability, not just popularity. Identify models/versions with the best volume-to-profit ratio and design specific campaigns to boost them.

- Refine trade-in appraisals. Use objective criteria, market references, condition checklists, and keep an eye on ageing. Good appraisals protect margin.

- Make financial costs visible. Don’t leave subsidized rates, deferred bonuses, or absorbed interest “off the books.” They must impact where they should: profitability.

- Audit transaction costs. Documentation, registration, commissions, and the “small” expenses that add up per unit.

- Professionalize the sales experience. Clear advice and transparency with customers reduces haggling and sustains healthier prices.

- Measure profitability by salesperson and channel. Volume alone isn’t enough. A KPI of average net profit per sale aligns behavior with results.

Closing Well Means Measuring Better

A well-analyzed performance indicator can change the course of the entire business. When measuring and acting accordingly becomes a habit, you stop flying blind.